Plastic recycling labels are everywhere: The ubiquitous “chasing arrows” symbol adorns everything from plastic bags and water bottles to kids’ toys.

Most commonly, these symbols appear with a number — 1 through 7 — that identifies the type of plastic resin a product is made of. A number 1, for instance, corresponds to polyethylene terephthalate, or PET — the stuff that makes up water bottles. Number 6 is for polystyrene, used in foam cups and trays. The plastics industry insists these icons were never meant to indicate a product’s recyclability, even though that is how they are often perceived by consumers.

In fact, most plastics are not recyclable, largely because there is no market for materials labeled 3 through 7. But that hasn’t stopped the widespread use of the chasing arrows.

Resin identification codes for polystyrene, left, and polypropylene: danielvfung / Getty Images; Mike Bitzenhofer via Getty Images

With no federal program to evaluate products’ recyclability and issue labels for them, third-party organizations have stepped in to play this role instead. One organization in particular, How2Recycle, has devised an elaborate hierarchy with several versions of its own recycling symbol, which it sells to hundreds of companies ranging from Lowe’s to Beyond Meat.

The organization, whose parent nonprofit is based in Virginia, says it analyzes waste management systems nationwide to figure out whether companies’ products and packaging are recyclable and then issues a corresponding label. It’s ostensibly an attempt to clear up confusion among consumers about what should and shouldn’t go into the blue bin. The group describes its markers as “recycling labels that make sense.”

This summer, How2Recycle declared a big victory for the companies it sells labels to: It now considers a wide set of products made from polypropylene, or PP — the resin corresponding to the number 5 — to be “widely recyclable,” meaning the organization thinks that more than 60 percent of Americans have access to a curbside or drop-off recycling program that accepts them. Polypropylene accounts for about 14 percent of the U.S.’s plastic production.

The announcement makes polypropylene tubs, bottles, and jars — things like yogurt containers and ketchup bottles — eligible for How2Recycle’s top-tier recycling label: a chasing arrows symbol with no qualifications.

But industry experts and environmental advocates have raised their eyebrows. Based on federal recycling data, independent national waste management surveys, and firsthand accounts from material sorting facilities, polypropylene recycling isn’t nearly as widespread as How2Recycle’s labeling implies. Even if PP products were technically accepted by facilities that serve a majority of Americans — which researchers say they are not — polypropylene is much more commonly landfilled or incinerated than turned into new products. This is because it is often filled with toxic chemical additives or contaminated with food waste, both of which make it difficult to turn it into new products. It’s usually less economical to sort out polypropylene for recycling than to simply discard it and make new products from virgin material.

Recycling labels from How2Recycle. Grist / Joseph Winters

“Post-consumer PP packaging and products have never been recyclable or recycled … above a few percent,” said Jan Dell, an independent chemical engineer and founder of the advocacy group The Last Beach Cleanup. Through How2Recycle, she said, plastic and packaging companies are “creating their own non-verified data” and ignoring key provisions of the Federal Trade Commission’s Green Guides, a set of requirements meant to prevent companies from making deceptive claims about the environmental benefits of their products.

As a result, Dell said, the industry has been allowed to deepen the public’s confusion about recycling, gulling people and policymakers into thinking that it will be able to keep pace with plastic manufacturers’ plans to dramatically scale up production.

How2Recycle is part of a labyrinth of organizations and industry membership programs that promote “sustainable materials management.” When it officially launched in 2012, the organization branded itself as an attempt to clear up confusion among consumers about what they could recycle. Many companies — including Yoplait, Costco, REI, and Microsoft — were quick to sign on, eager to affix How2Recycle’s labels to their products.

The program took the onus off of individual companies for claims about recyclability. How2Recycle would do all the necessary research into specific products’ recycling rates and community access to recycling programs, allowing participants to rest assured that their recycling labels were compliant with federal law. Today, more than 400 companies pay annual membership fees to place How2Recycle labels on their packages, including Amazon, Clif Bar, Walmart, Johnson & Johnson, and Starbucks.

At the top of How2Recycle’s labeling hierarchy is a simple “chasing arrows” recycling symbol, which the organization gives to products that it says are accepted by curbside or drop-off recycling programs that serve at least 60 percent of the American population. This is the label that How2Recycle said in late July some polypropylene products would now be eligible for. Previously, in 2020, the organization had downgraded PP products from the unqualified chasing arrows to a “Check Locally” label that instructed consumers to verify whether their community’s recycling program would accept them.

“As rigid polypropylene access, sortation, and end markets are on an upward trend across the U.S., we are excited to upgrade this packaging format,” Caroline Cox, How2Recycle’s director, said in a press release this summer.

However, other sources paint a very different picture of the United States’ plastic recycling landscape — especially for polypropylene, which is far more difficult to turn into new products than How2Recycle’s labels make it seem. “It is not possible that 60 percent of Americans have access to established recycling systems that accept PP packaging of any type,” Dell, of The Last Beach Cleanup, said.

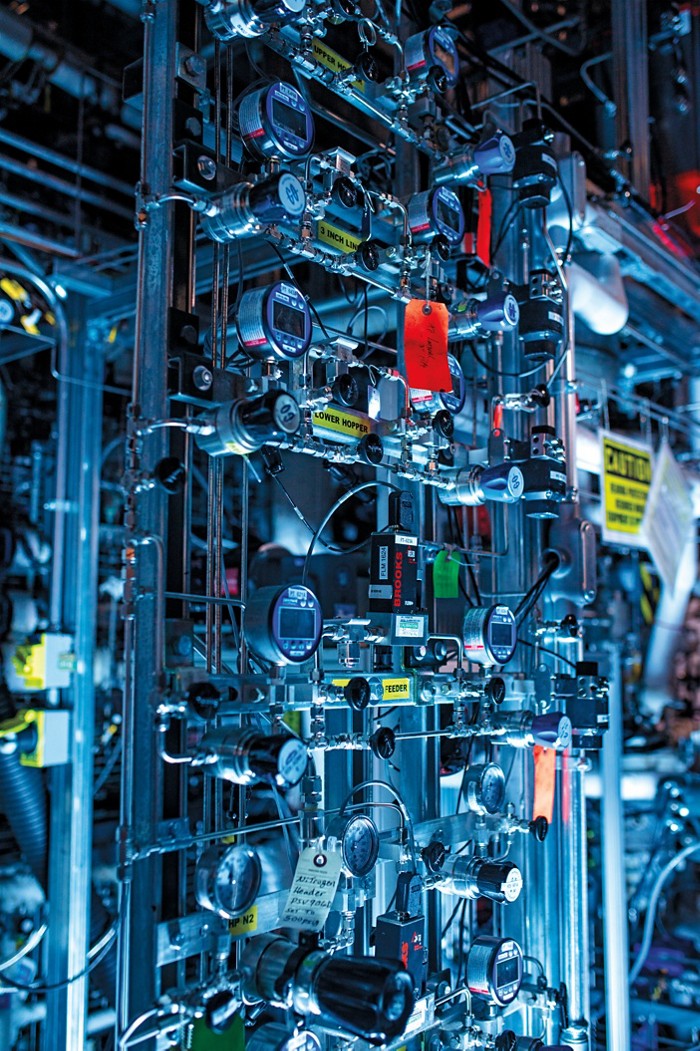

Workers sort through plastic and other materials at a material recovery facility, or MRF. Lauren A. Little / MediaNews Group / Reading Eagle via Getty Images

First, she explained, industry data suggests that only 60 percent of Americans have access to any recycling program, let alone one that accepts polypropylene containers. Most facilities only accept plastics that are easier to recycle, such as bottles made of PET. And additional data that Dell is compiling for 2022 shows that only half of the country’s 373 material recovery facilities, or MRFs — specialized plants that process and sort all the items people toss in their blue bins — say they accept polypropylene tubs, one of the most recyclable PP products out there (think margarine containers and cottage cheese cups). As a result, only 28 percent of Americans have access to recycling programs that accept these polypropylene containers.

“Overall accessibility for plastic recycling has dropped, if anything,” said John Hocevar, Greenpeace’s oceans campaign director. In recent years, labor shortages and high prices for recycled materials have caused cuts in curbside recycling programs, and many MRFs have stopped accepting most plastic resins.

What’s more, Hocevar and others argue that the accessibility of recycling programs is a distraction from a more important metric: the real recycling rate. Just because polypropylene is collected doesn’t mean it will ultimately be recycled. According to the most recent available data from the Environmental Protection Agency, only 2.7 percent of polypropylene “containers and packaging” were recycled in 2018. If you include all forms of polypropylene, that number falls to just 0.6 percent.

One reason PP is difficult to recycle is that it’s not as clean or pure as other kinds of plastic. Unlike products made from PET or high-density polyethylene (HDPE) — labeled with the numbers 1 and 2, respectively — polypropylene products, labeled with the number 5, often contain toxic additives that make it difficult to turn them back into usable items. Another reason is that PP is typically collected in bales of mixed plastic that include a variety of resins labeled with the numbers 3 through 7.

In order to be recycled, PP must be picked out of these bales and then sold to an extremely limited number of facilities that will actually accept that plastic. (In 2020, Greenpeace estimated that the U.S. only had enough processing capacity to recycle less than 5 percent of its PP waste.) The whole process is prohibitively expensive, especially since the final product must be competitively priced against virgin plastics. According to the EPA, the U.S. generated more than 8 million tons of polypropylene waste in 2018, the most recent year for which data are available.

Read Next

California passes nation’s toughest plastic reduction bill

Jeff Donlevy, a member of California’s Statewide Commission on Recycling Markets and Curbside Recycling and general manager of Ming’s Recycling, a company based in northern California, said that many facilities continue to accept polypropylene — even if they have no intention of recycling it — because of outdated, 10-or-more-year contracts with cities. At the time when many of these contracts were signed, MRFs said they would accept polypropylene because they could send mixed plastic bales to China for sorting and recycling. But in 2018, when China enacted its “National Sword” policy and closed its borders to most plastic waste imports, U.S. MRFs were saddled with a glut of resins that are uneconomical and logistically difficult to turn into new products.

Of the roughly 80 MRFs in California, Donlevy said the vast majority are not recycling plastics made of resins labeled number 3 and above. This includes polypropylene, number 5. Most facilities are “just landfilling whatever number 5 they get,” he said.

How2Recycle says on its website that it takes four factors into account when determining a product’s recyclability — collection, sortation, reprocessing, and end markets — but it is not transparent about the exact methodology it uses to evaluate these criteria. Much of its data comes from an industry report conducted by How2Recycle’s parent organization that looks at a “non-random” sample of large recycling programs throughout the U.S., along with a random sample of recycling programs in smaller communities. In the most recent edition of the report, these censuses consisted of web searches for each recycling program to determine what kinds of plastic they accept.

Environmental advocates question the results of these analyses, but they say the larger issue is that How2Recycle fails to say anything about the real recycling rate of PP products. Again, the “widely recyclable” label is only supposed to reflect a material’s acceptance by curbside and drop-off recycling programs. But this information is not printed on the organization’s unconditional recycling labels. Donlevy said this oversight “misleads the public.”

It may also contravene sustainable packaging guidelines from the Federal Trade Commission, or FTC, a government agency that promotes consumer protection. By slapping recycling labels without qualifiers onto polypropylene tubs and other containers, How2Recycle appears to be ignoring key provisions of the FTC’s Green Guides, a set of detailed but nonbinding requirements for claims about products’ environmental benefits. The U.S. government does not have a program to issue or approve recycling labels, so this is the primary check for labels created by private groups.

At the broadest level, the FTC says it is deceptive to “misrepresent, directly or by implication, that a product or package is recyclable.” This means that companies should not use a recycling label without qualifiers — like How2Recycle’s gold standard chasing arrows symbol — unless they can prove that recycling facilities for their labeled products are available to at least 60 percent of consumers. Critically, the commission also calls on companies to substantiate that these facilities “will actually recycle, not accept and ultimately discard” labeled products.

Marketers “should not assume that consumers or communities have access to a particular recycling program merely because the program will accept a product,” the FTC says in the Green Guides’ statement of basis and purpose. Although the guides aren’t legally binding, activity that is inconsistent with them can be used as evidence of a violation of the FTC Act’s provisions on “Unfair or Deceptive Acts or Practices” and can result in fines or additional rulemaking. State governments can also cite the Green Guides when building false advertising or consumer protection cases.

Dell lamented that the FTC has never, to her knowledge, taken action to stop a company from misusing an unqualified recycling label. But courts have. Take, for example, a 2018 lawsuit filed by a consumer against Keurig over claims that the company’s polypropylene coffee pods were “recyclable.” Keurig argued that its labels were consistent with the Green Guides, but a U.S. District Court in California disagreed and refused to dismiss the case. The court said that even if the coffee pods were technically collected by municipal recycling programs, they were not in practice being recycled. Keurig settled the case this year for $10 million and has changed the labels on its coffee pods.

Keurig coffee pods. Joe Raedle / Getty Images

Greenpeace argues that How2Recycle is using similar sleight with its own labels, claiming recyclability with insufficient substantiation. “Polypropylene does not come close to meeting the requirements” for recycling labels laid out by the FTC, the organization said in a press release. It is neither accepted at recycling facilities that serve 60 percent of the population nor actually recycled at a significant rate.

In response to Grist’s request for comment, Paul Nowak — executive director of How2Recycle’s parent organization, GreenBlue — said that How2Recycle’s labels not only satisfy the Green Guides’ requirements but “go beyond them.” Although How2Recycle does not have internal data on the real recycling rate for polypropylene, Nowak said How2Recycle has reviewed “letters of support” from MRFs saying that they plan to expand their recycling capacity for polypropylene. Nowak declined to share these letters with Grist.

How2Recycle’s website offers some clarification. Although the organization claims to consider “sortation” and “reprocessing” for products that will feature its labels, How2Recycle explains online that it ultimately does not take into account the real-world recycling rate when evaluating a product’s recyclability — in contrast to definitions of recyclability from other organizations, like the Ellen MacArthur Foundation, an international nonprofit that advocates for a circular economy.

Nowak insists that How2Recycle spent “several months” verifying data on the increased recyclability of polypropylene. But Dell thinks there’s an irresolvable conflict of interest at play, since How2Recycle and the organizations whose data it cites are run and funded by companies that make and sell plastics. “We’ve got all these front groups funded by the plastics and products industry to create and perpetuate the myth that plastics are recyclable,” she said.

Read Next

‘We can’t recycle our way out’

The recent push to make polypropylene “widely recyclable” started outside How2Recycle, with a separate industry group called the Recycling Partnership — a nonprofit whose board of directors includes executives for major brands and plastic industry groups: Keurig Dr. Pepper, Nestlé, the Association of Plastic Recyclers, and the American Beverage Association, among others. The organization lists roughly 80 “funding partners” on its website, including two of North America’s main petrochemical industry trade groups, the American Chemistry Council and the Plastics Industry Association.

In 2020, a few months after How2Recycle downgraded PP products to only be eligible for the “Check Locally” label, the Recycling Partnership launched a new initiative — directly funded by many plastic brands and industry trade groups — to “ensure the long-term viability of polypropylene.”

The Recycling Partnership claims it contributed to a spike in polypropylene recycling over the past two years through a series of 24 grants worth $6.7 million. The group did not respond to Grist’s request for more information, but a press release notes that the funding helped “support sorting improvements and community education across the U.S.” According to the Recycling Partnership, these grants increased the amount of polypropylene recovered by 25 million pounds annually. Now, the group says its proprietary “National Recycling Database” shows 65 percent of Americans having access to PP recycling.

According to Nowak, the Recycling Partnership approached How2Recycle with this data in early 2022, requesting that How2Recycle reevaluate its labeling for polypropylene. After what Nowak described as a lengthy evaluation process, he said the data matched what he was seeing with How2Recycle’s own analysis, as well as information provided by an outside consulting firm. In response to Grist’s request for comment, the consulting firm said it provided How2Recycle with access-to-recycling data and “end market” research to show there is a market for polypropylene that ultimately does get recycled. The firm did not share data on polypropylene’s real recycling rate and told Grist to reach out to the Recycling Partnership.

How2Recycle, meanwhile, has its own web of connections to big brands and the plastics industry. The group’s parent organization, the Sustainable Packaging Coalition, is an industry working group whose members include Procter and Gamble, Coca-Cola, and the ExxonMobil Chemical Company, as well as a host of other plastic makers. GreenBlue, the umbrella organization that houses How2Recycle and the Sustainable Packaging Coalition, has a board of directors that includes executives from the Dow Chemical Company, Mars, the packaging companies Printpack and Westrock, and more.

Nowak said he is aware of concerns over potential conflicts of interest, but that How2Recycle’s parent organizations are “very careful about who we start to work with.” At How2Recycle, he added, “we stay neutral in all that.”

Dell has often spoken of the plastic labeling landscape as the “wild, wild West,” with “no sheriff in town” to protect consumers from deceptive recycling claims. The FTC, whose Green Guides may soon be updated for the first time since 2012, declined to comment on How2Recycle’s labeling system, and environmental advocates have expressed frustration that the commission hasn’t done more to enforce the guidelines.

Without stronger government regulation, Dell said, “How2Recycle and the product companies have filled the void to become the deciders” of what should and shouldn’t bear the recycling label.

But states are catching on. California passed nation-leading legislation last year making it illegal for companies to use the chasing arrows on products that are not actually being turned into new products. (In this case the state, rather than How2Recycle, will determine recyclability, and it will take into account both collection and the real recycling rate.) The law is expected to eliminate recycling symbols on virtually all plastic packaging that isn’t made of number 1 or number 2 resins, since those are the only kinds of plastic currently being recycled with significant regularity. It could have an impact on other states, too — if plastic manufacturers decide it is too cumbersome to create new product lines for the California market, they could decide to remove recycling symbols for the whole country.

Hocevar of Greenpeace said the California bill is an important step in the right direction and called on other states to adopt similar policies. Environmental advocates have also cheered a separate effort from the California attorney general’s office, which announced in April that it was launching an investigation into the petrochemical industry’s “aggressive campaign to deceive the public” about the feasibility of recycling.

Representative Alan Lowenthal speaks during a news conference about the Break Free From Plastic Pollution Act in 2020. Sarah Silbiger / Getty Images

To truly address the plastic pollution crisis, Hocevar and others say that the top priority should be turning off the tap — limiting the production of plastic that ultimately has to be dealt with. In the U.S., perhaps the most promising move in this direction is the proposed Break Free From Plastic Pollution Act, a far-reaching federal bill that would ban carryout plastic bags and other single-use plastic products, require plastics companies to launch and finance programs to manage the waste they produce, and place a moratorium on new petrochemical facilities until the EPA can undertake a comprehensive assessment of the industry’s environmental impact.

In the meantime, Donlevy said that companies should stop trying to trick consumers into feeling good about their plastic consumption. “Producers have to realize they’re using plastic for their benefit and for the consumers’ benefit, which is fine,” he said. “But to put a recycling symbol and say that that cottage cheese or cream cheese or sour cream container is recyclable? You don’t need to do that, that’s not a part of the sales pitch. … The only plastics that are really getting recycled in the U.S. are number 1 and number 2 bottles.”