MILAN, Jan 13 (Reuters Breakingviews) – Investors should worry about a rising plastic tide. The pandemic and a war in Ukraine have focused money managers’ attention on supply chain disruption and energy security risks. Yet as the world continues to drown in packaging waste, the public and private sectors may come after big users like PepsiCo (PEP.O), Coca-Cola (KO.N) and Mars.

Four years after the consumer goods giants signed up to voluntary reduction targets under the New Plastics Economy Global Commitment, progress is disappointing. Ellen MacArthur Foundation data shows that the packaging employed by companies like PepsiCo, Mars and Coca-Cola increased its usage of virgin plastic, made from fossil fuels rather than recycled materials, by 5%, 3% and 11% respectively between 2019 and 2021. That makes it unlikely they can meet their commitments to curb its use by 5%, 20% and 25% by 2025.

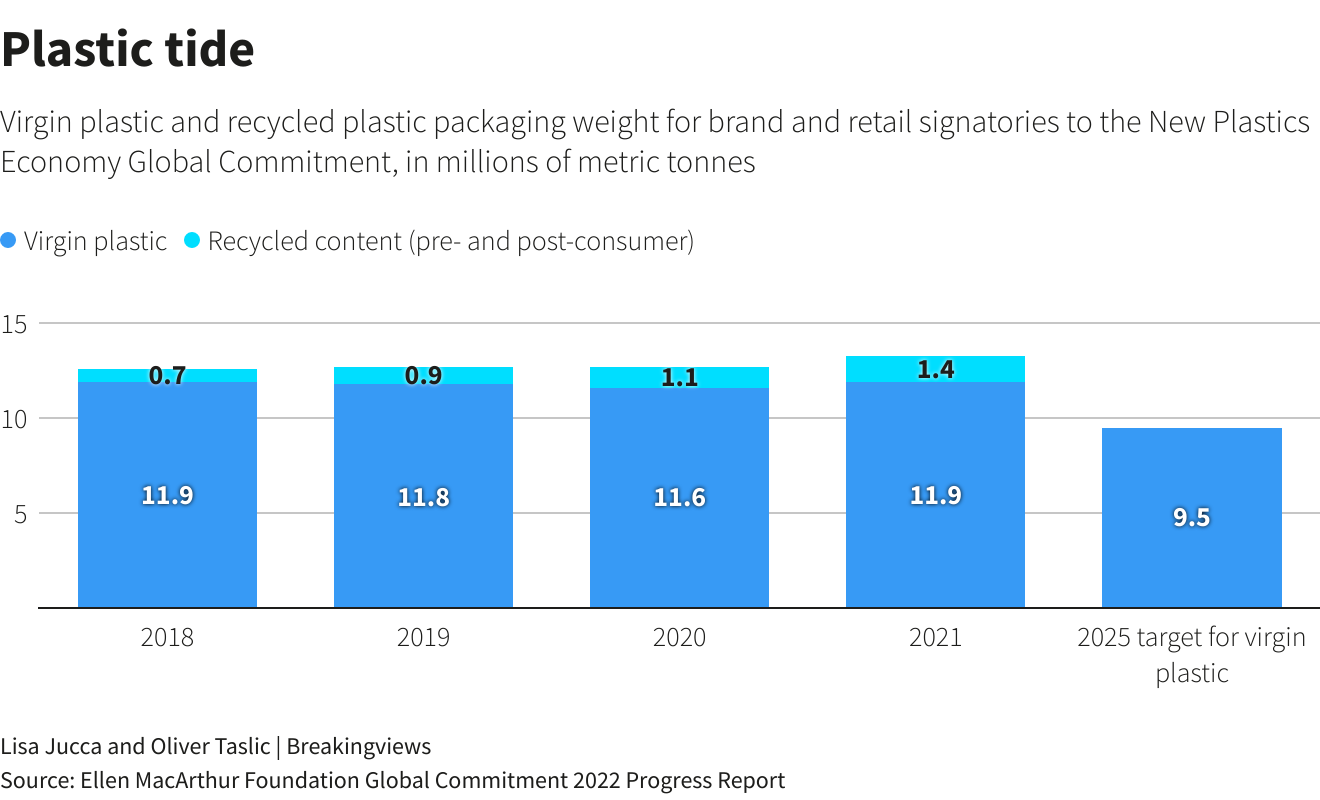

Big plastic users are also making insufficient progress in using recycled material. The latter amounts to just 10% of plastic packaging used by pact signatories. Reusable containers, the most environmentally friendly form of packaging, amounted to only 1.2% of the total in 2021, and that figure is decreasing.

Despite citizens’ effort to sort out used plastic for collection, especially in Europe, only 9% actually gets recycled each year, the Organisation for Economic Co-operation and Development says. In the United States 73% of plastic waste ends up in landfills, where it takes up to 500 years to decompose. The rest gets incinerated or washes up on developing countries’ shores. That will only worsen as annual demand of about 450 million tonnes a year is expected to treble by 2060.

Solving the plastic challenge is complex and expensive. Plastic comes in different types that cannot be bundled together. Certain materials or additives make it difficult to recycle. Substituting plastic with biodegradable material can be expensive. Using recycled plastic, while less energy-intensive than creating virgin plastic, can cost more overall.

Yet, having pledged to act, big corporates are in a vulnerable position. Danone (DANO.PA) is facing a legal challenge over its plastic use. In March, 175 governments agreed to work out binding laws to end plastic pollution by end-2024. Around 70% of citizens surveyed last year in 34 countries want new anti-plastic rules.

European investors’ greater focus on sustainability means they are more likely to hassle domestic laggards. But if governments decide to implement mandatory recycling quotas, rival U.S. late-starters would suffer the most. In a worst-case scenario, companies could face a collective $100 billion annual bill if lawmakers ask them to cover waste management costs in full, the PEW Charitable Trusts says.

For investors, plastic inaction could become toxic.

Follow @LJucca on Twitter

(The author is a Reuters Breakingviews columnist. The opinions expressed are her own. Updates to add graphic.)

CONTEXT NEWS

Representatives of 175 countries endorsed in March a landmark resolution to develop international legally binding instruments to end plastic pollution. Negotiations on the new legal instruments kicked off on Nov. 28 with the aim of finalising a binding agreement by 2024.

Germany will ask makers of products containing single-use plastic to contribute to the cost of collecting litter in streets and parks from 2025 by paying into a central fund managed by the government. In 2008 the Netherlands introduced a packaging waste management levy.

Corporate signatories of the New Plastics Economy Global Commitment launched by the Ellen MacArthur Foundation and the U.N. Environment Programme in 2018, which include PepsiCo, the Coca-Cola Company, Nestlé, Danone and Unilever, are likely to miss several if not all of their targets for tackling plastic pollution. That’s according to progress report by the Ellen MacArthur Foundation published in November.

Collective use of virgin plastic by the signatories of the anti-plastic pact has risen 2.5% year-on-year to 11.9 million metric tonnes in 2021, bringing it to the same level it stood at in 2018. Meanwhile, the share of reusable plastic in packaging has fallen to an average 1.2% of total, the report showed.

Editing by George Hay, Streisand Neto and Oliver Taslic

Our Standards: The Thomson Reuters Trust Principles.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.